Freddie Mac - Making Home Happen For You

Ever wonder how so many people manage to find a place to call their own, whether it's buying, renting, or just keeping up with payments? It's a big part of life, that feeling of having your own space, a spot where you can just be. So, when we talk about making homes possible, we are really talking about helping folks get to that comfortable place, a place that feels right. This often involves a lot of behind-the-scenes work, the kind of things that help money flow smoothly to where it needs to go, so you can pick out that perfect couch or paint the walls your favorite shade.

You know, for a lot of us, the idea of getting a house or even a nice apartment can seem a little far off, like something you wish for rather than something you can actually reach. But there are groups out there, working quietly, to try and bridge that distance, to make those wishes a bit more tangible. They do this by making sure that the money needed for home loans is available to lenders, which then helps regular people, like you and me, get the funds we need to secure a place to live. It's a pretty essential role, if you think about it, because without that initial push, many home dreams would just stay dreams.

It's not just about getting the money out there, either; it's also about making the whole process feel a bit less intimidating. Think about all the different pieces that go into buying or even just renting a place – there are tools and bits of information that can make a real difference. And, as a matter of fact, that's where some organizations step in, providing helpful pointers and resources to simplify what can sometimes feel like a very big puzzle. They are, in a way, trying to smooth out the path to homeownership or even just finding a good rental, making it more straightforward for everyone involved.

Table of Contents

- Who is Freddie Mac and What Do They Do?

- Freddie Mac's Role in Housing

- How Does Freddie Mac Help Everyday People?

- Finding Your Place with Freddie Mac's Tools

- Are There Job Openings at Freddie Mac?

- The Freddie Mac Income Calculator - A Closer Look

- What's New with Freddie Mac's Guidelines?

- Understanding Tax Abatements and Freddie Mac

Who is Freddie Mac and What Do They Do?

So, you might be wondering, who exactly is Freddie Mac? Well, it's almost like a quiet helper in the background of the housing scene, working to make sure that people have a real shot at finding a home. They don't directly give you a mortgage, no, but they play a pretty big part in making sure that lenders, the banks and credit unions you usually go to, have the money they need to offer home loans. Think of it like this: they provide the fuel for the engine that drives home financing across the country. This means more options for you when you're looking to buy, rent, or even just manage your current home. They've been at this for quite some time, too, since the 1970s, which is a fairly long stretch of helping folks.

Freddie Mac's Role in Housing

In some respects, Freddie Mac has a job that's all about making housing more attainable and also a bit more reasonably priced for people from coast to coast. They do this by purchasing mortgages from lenders. This action, you see, gives those lenders fresh money, which they can then use to offer even more home loans to other people. It's a cycle that, in a way, keeps the housing market moving along. Without this kind of support, lenders might run out of funds to give out, which would make it much harder for many to get a mortgage. So, their contribution is about keeping the flow of money going, making sure that the dream of owning a place is within reach for more people, not just a select few.

How Does Freddie Mac Help Everyday People?

You might not interact with Freddie Mac directly when you're looking for a home, but their influence is certainly felt. They create tools and put out resources that are designed to help you, the everyday person, whether you're trying to buy your very first house, manage the one you already have, or even if you're just looking for a good place to rent. These resources are often things like guides or informational pieces that simplify what can sometimes feel like a rather complex process. They aim to give you the information you need to feel more sure of yourself when making big decisions about where you live. It's about giving you a little bit of extra confidence, that is that.

Finding Your Place with Freddie Mac's Tools

Consider, for example, the various things they offer to help you out. It's like having a helpful friend who knows a lot about real estate. They provide bits of information and practical aids that can guide you through the steps of homeownership or even finding a rental. These tools are often available online, making them easy to get to whenever you need them. They cover things from understanding the steps involved in purchasing a home to getting a handle on the costs of maintaining one. This support is there to make the journey a bit smoother, giving you practical ways to approach what can be a very significant life event. They just want to help you find your footing, you know, when it comes to your living situation.

Are There Job Openings at Freddie Mac?

Interestingly enough, beyond helping people find homes, Freddie Mac is also a place where many people work. If you're looking for a new professional path, or perhaps a change of scenery in your career, they do have job opportunities. You can search for available positions that might fit your unique abilities and professional background. It’s a bit like looking for any other job, really, where you match what you can do with what they need. So, if you've ever thought about working in a place that helps shape the housing market, it might be worth taking a peek at what they have open. They're always looking for good people, apparently, to help with their mission.

The Freddie Mac Income Calculator - A Closer Look

One very practical tool they offer is something called the Freddie Mac income calculator. This is a free, online helper that allows you to figure out different kinds of borrower income with a good deal of ease and also with a sense of certainty. You can use what you find from this calculator on its own, or you can use it alongside other information you might have. It's designed to give you a clearer picture of financial situations, which is pretty helpful when you're trying to figure out what kind of home loan might work for you. It simplifies a part of the process that can sometimes feel a bit complicated, giving you a clearer path forward, you know, for your financial planning.

Sometimes, this income calculator will give you messages if it can't figure out the income for some reason. It will even tell you why it couldn't assess the income, which is quite helpful. This transparency means you're not left guessing; you get a clear explanation. It’s all part of making sure that people have the best information possible when they're looking into home financing. This little feature helps a lot in preventing confusion and gives you a better idea of what steps you might need to take next. It's really about making sure you have all the facts, that is that.

What's New with Freddie Mac's Guidelines?

Just like with many things, the rules and guidelines around home financing can change over time. Freddie Mac, for instance, makes sure to keep their instructions updated for those who sell or service multifamily properties. They've recently made some adjustments to their multifamily seller/servicer guide. If you're involved in that part of the housing world, it's a good idea to check out the news article they put out about these changes. Staying current with these kinds of updates is important for anyone working with them, as it helps everyone stay on the same page and keeps things running smoothly. It's about keeping up with the times, more or less, to serve everyone better.

Understanding Tax Abatements and Freddie Mac

There's also some recent news about how they look at tax abatements when figuring out certain mortgage calculations. A tax abatement, for those who might not know, is like a temporary break on property taxes, which can be a big help for homeowners. Freddie Mac is updating how they calculate the debt coverage ratio, or DCR, for mortgages that have these tax abatements. Specifically, they're clarifying what happens if one of these tax breaks runs out more than ten years after the mortgage begins. This sort of detail is pretty important for lenders and borrowers alike, as it affects how a mortgage is underwritten and how sustainable it is considered. It’s just a little adjustment that can make a difference in certain situations.

You can still use the results from their calculator independently, even with these changes. It's a tool that provides valuable insights, and its core purpose remains the same: to help you get a clearer picture of financial details related to homeownership. So, whether you're dealing with a tax abatement or just trying to understand income, the calculator is there to assist. It's all about making the complex bits of home financing a little bit easier to grasp, helping you feel more confident about your choices.

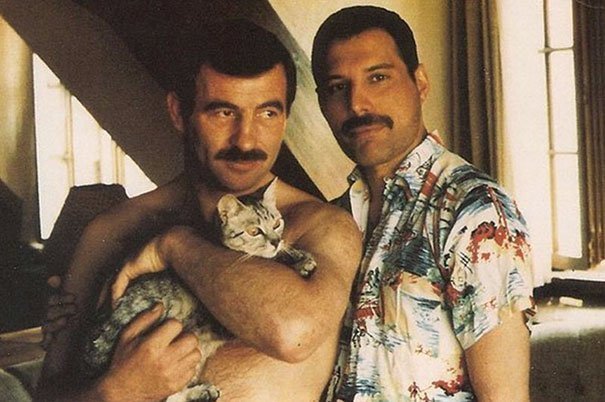

Rare Details About Freddie Mercury's Last Relationship

Jim Hutton, Partner Of The Late Freddie Mercury, Dies At 60 - Towleroad

Biografia de freddie mercury tudo sobre o cantor do queen – Artofit